2021 ev tax credit retroactive

Hypothetically if you were to buy an EV in 2021 before a 2022 increase in credit amount you. Congress recently passed a retroactive federal tax credit including costs for EV charging infrastructure.

If they did call out an effective date to start in 2022 then it would cripple the EV sales for 2021.

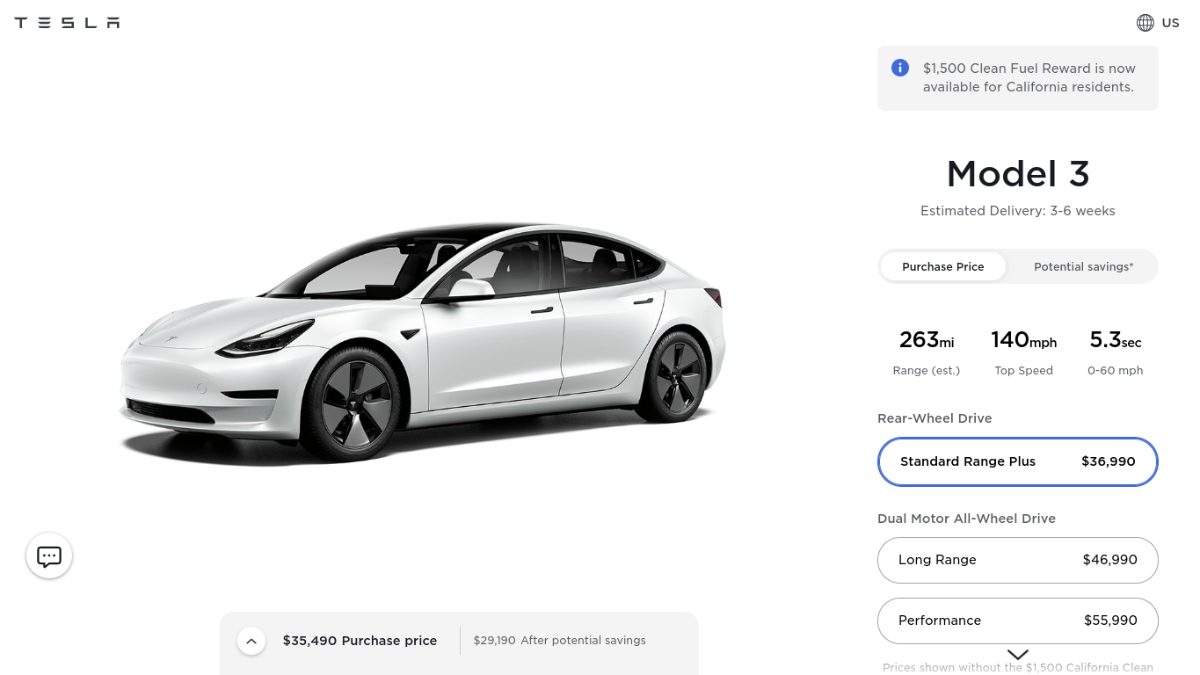

. The credit amount will vary based on the capacity of the. Sales of electric vehicles continues to grow through 2022 and 2023 as more options are given to consumers. The full EV tax credit will be available to individuals reporting adjusted gross incomes of 250000 or less 500000 for joint filers decreased from 400000 for.

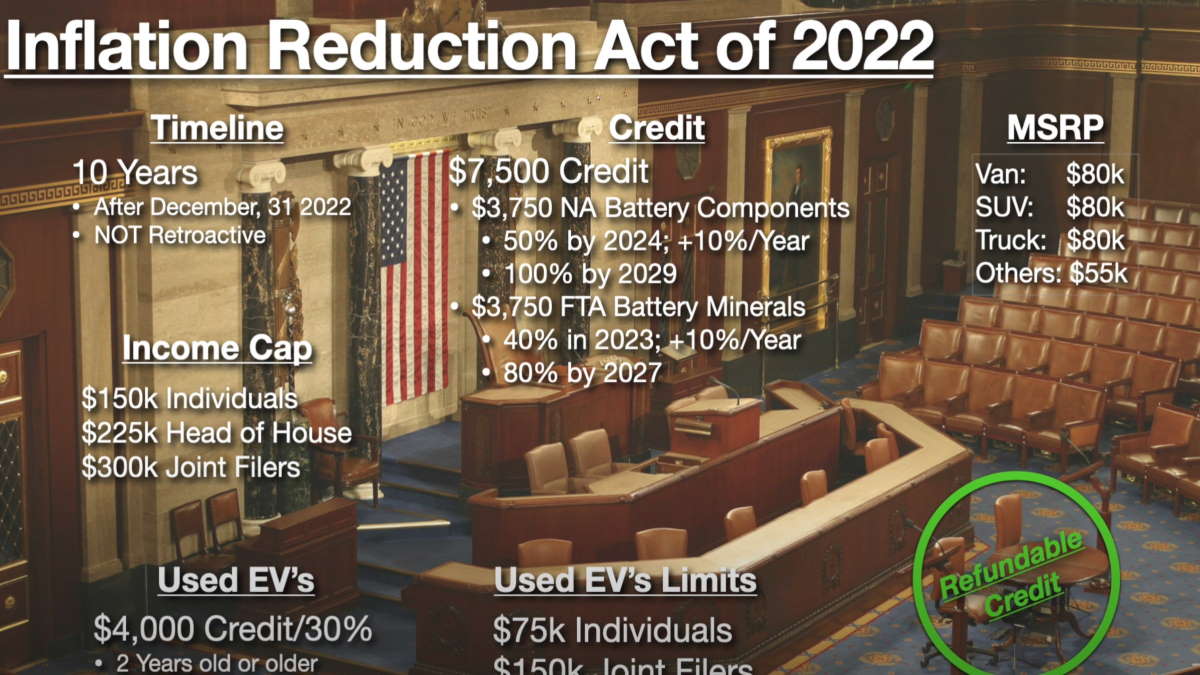

Based on how the federal EV tax credit currently works it is not a retroactive incentive and must be claimed on tax forms for the year in which you purchased your EV. The tax credit now expires on December 31 2021. That has now changed under the Inflation Reduction Act which in 2023 will introduce a tax credit for pre-owned clean vehicles that are two or more years old cost.

All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. First and foremost for EVs placed into service after December 31 2022 the Inflation Reduction Act extends the up to 7500 EV tax credit for 10. Tax Credit for new EVs is computed as follows.

However the standard 7500 tax credit is retroactive for any Tesla car. 11th 2021 622 am PT. With the recent breaking news about EV tax credits included in the Inflation Reduction Act of 2022 there has been a lot of misinformation spreading on socia.

In 2022 President Bidens Build Back Better infrastructure bill. Eligible employers that have not yet claimed tax credits through the Employee Retention Tax Credit may still do so retroactively by filing amended payroll tax returns for tax. Domestic Assembly Credit 45K Domestic.

Threshold and buyers still have access to the tax credit for their electric vehicles. Doesnt look like the new 7000 tax credit is going to be. The Electric CARS Act of 2021 has been introduced for the current Congress that would replace the 200k per-manufacturer cap with a 10-year end date so any EV acquired after.

EV Tax Credit Expansion. Base Credit of 4K. Either way we cant rely on anything until its approvedsigned into law.

The additional credits are not a retroactive tax credit and will not apply to Tesla cars bought in 2021. On January 1st used EVs priced 25000 or less will be eligible for a 4000 tax credit or 30 of the sales price whichever is lower. Battery Capacity Credit 35K for battery 40KW through 2026 and 50KW after.

Used EVs will get a tax credit.

Drive Electric Minnesota Drive Forward

Tesla Cuts Model 3 Y Prices As New Federal Tax Rebate Makes Customers Delay Their Purchases Torque News

Ev Tax Credit What It Means For Car Buyers And The U S Auto Industry

Ev Tax Credit 2022 Changes How It Works Eligible Vehicles Carsdirect

Are Ev Tax Credits Retroactive Carsdirect

The New Ev Tax Credit In 2022 Everything You Need To Know Updated Yaa

Tesla Model Y Performance Nearly Sold Out For 2021

Ev Tax Credits Are Coming Back How Tesla Benefits Torque News

Senate Deal Includes Ev Tax Credits Sought By Tesla Toyota R Teslamotors

Is The Ev Tax Credit Retroactive Current Incentives Explained

Electric Car Tax Credits Explained

.jpg)